The Impact of Dividing Debts at Divorce

Allison Gerli • September 22, 2020

What Happens To Debt After Divorce? Who is Responsible? What You Need To Know.

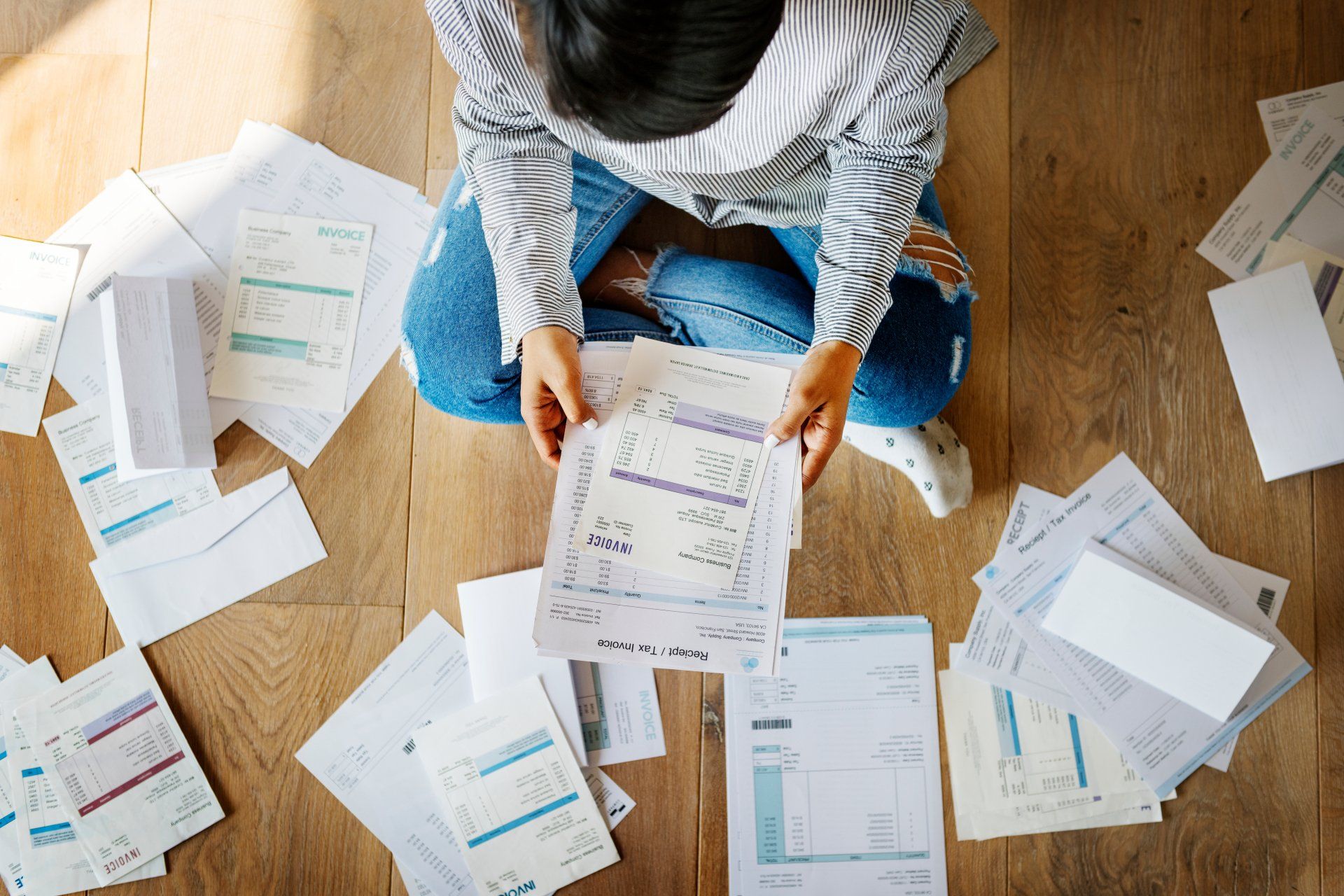

You and your spouse may have accumulated debts of various types during the course of your marriage. If so, you are probably concerned about how to divide those debts and what the consequences will be if the debts are not paid, particularly if you do not trust that your spouse will be responsible about making payments.

If a debt was undertaken by you and your spouse jointly (generally the case for home mortgage and car loans, and often the case for credit cards), you and your spouse probably are jointly and severally liable

for payment of that debt. This means that the creditor can pursue either or both of you to obtain payment.

The creditor (bank, mortgage company, department store, credit card company, etc.)

is not a party to your dissolution of marriage proceeding. In the divorce settlement, the debts will be allocated between you and your spouse by agreement or, if you have a trial, the Judge will order who is responsible for each debt.

Despite the allocation of debt in a divorce judgment, debts in joint names will remain in joint names, unless the person the debt is allocated removes the other party from responsibility. The creditor is not bound by any agreements reached between the two of you as to who is responsible post-divorce, nor is it bound by a court order as to who is responsible for the debt. A creditor can still pursue either you or your spouse for an unpaid debt, regardless of who the court designates to pay the debt.

As a result, it is important to understand that, even when a court specifically orders that one party is solely responsible for payment of a home mortgage or other loan or other debt, if both parties’ names remain on the loan or debt, both parties remain responsible for its payment. Transfer of the title of your home by quitclaim or other deed does not in any way alter your obligation under an existing mortgage loan.

The divorce judgment may include an indemnification and hold harmless clause. Typically, these provisions are used so that a party who agrees or is ordered to pay a certain debt is responsible for reimbursing the other party if the other party ends up paying the debt instead. Although these clauses do provide you with recourse through the courts should your former spouse fail to pay a debt, as a practical matter, if the creditor has been unable to collect form your former spouse, your chances of doing so are not much better. Your goal should be to reduce the risk of problems related to the marital debt post-divorce.

What To Consider When Settling Your Case

If you are hoping to settle your case, it is important to consider your spouse’s likelihood to responsibly pay the debt that is allocated in the settlement. The spouse’s failure to pay, or failure to pay on time, can affect your credit rating and of course impact you in other ways.

Sometimes parties agree to delay selling or refinancing the house for a period of years so that one of the spouses can remain in it after the divorce. Often that spouse is not able to qualify to refinance at the time of divorce. If you are the non-resident spouse and you are considering this option, you need to consider what this could mean if you want to purchase a residence or take on some other large debt before the time for your spouse to refinance or sell the home arrives. The obligation on the mortgage may result in your being denied credit, even if your spouse is paying the mortgage on time. This is something that we may need to discuss as settlement options are generated.

It may be important for both spouses to obtain credit reports to ensure all debt is being disclosed and addressed as part of the divorce process. This is something that can be requested of both parties to a divorce.

Please discuss your current debt situation with your attorney so that the appropriate measures such as closing accounts may be taken to protect your credit rating and preserve martial assets. You need to be aware of all outstanding debts when preparing settlement options or proposing how property and debt will be divided at trial.

If you have questions or concerns about your situation, the

attorneys at The Center for Family Law are here to help.

We are thrilled to announce that four of our attorneys have been recognized in the 2025 Super Lawyers® and Rising Stars lists! This distinction honors outstanding legal professionals across the nation who demonstrate excellence in their field, and we are proud to celebrate the exceptional achievements of our team. Celebrating Our Super Lawyer Ann Bauer has once again been recognized as a Super Lawyer in Missouri & Kansas, marking her 19th consecutive year on the list. Ann’s dedication, skill, and commitment to her clients have earned her additional prestigious honors: Top 50: Women Missouri & Kansas Super Lawyers – 11th year Top 50: St. Louis Super Lawyers – 7th year Ann’s recognition is a testament to her decades of experience and unwavering commitment to families and individuals navigating complex legal matters. Rising Stars of 2025 We are also proud to celebrate our three attorneys named Rising Stars this year: Allison Gerli – 8th year Kristen Sparks – 7th year Hallie Van Duren – 5th year The Rising Stars designation recognizes outstanding attorneys who are making a significant impact in their field earlier in their careers. What This Recognition Means The Super Lawyers and Rising Stars lists are highly selective, recognizing only a small percentage of attorneys in each state based on peer nominations, professional achievement, and other rigorous criteria. Being named to these lists reflects the consistent excellence, skill, and dedication our attorneys bring to every case. We are proud to have a team of legal professionals who combine experience, empathy, and expertise to serve our clients. Congratulations to Ann, Allison, Kristen, and Hallie for this well-deserved recognition!

We are proud to share that The Center for Family Law has once again been recognized as a Tier 1 law firm in St. Louis in the practice areas of Family Law and Family Law--Mediation. Firms named to the 2026 “Best Law Firms” list by U.S. News & World Report and Best Lawyers® are honored for their professional excellence, earning consistently strong ratings from clients and peers. A tiered ranking reflects a unique combination of quality legal practice and breadth of expertise. The 2026 “Best Law Firms” rankings, released this month, are based on client feedback, peer evaluations from leading attorneys, and additional information submitted by participating law firms as part of a comprehensive review process. About The Center for Family Law Since 2013, The Center for Family Law has provided progressive, client-centered family law services with compassion and dedication. Our attorneys are committed to advancing the practice of family law and adapting to its ever-evolving landscape. We partner with each client to address their unique needs and goals, helping families navigate challenging transitions with respect and care.